Building a product is no small feat. But many startups and even large companies miss the most critical piece in getting product market fit.

WARNING: This article has some harsh truths, but coming from a place of love. ❤️

Are you brave enough to read the rest of it?

The most critical mistake over 80% of companies make when launching a product is beginning with an idea, building a product and trying to force-fit it into the market that doesn't actually have that problem (or it's not big enough of an irritation to switch from current behavior).

It's the "build it, they will come" attitude.

After all, you're smart. You went to this great school, have spent 20 years in the business and KNOW this is a problem that's worth solving. Your team put together this great spreadsheet model that shows that the addressable market is at least a billion dollars. Can't believe nobody has tried this before!

Here are some critical considerations that many companies gloss over to justify building a product.

1. Market models can say whatever you want them to.

Excel models are relatively useful to build in order to test assumptions, but here's the problem: the assumptions have to be based in reality.

I've been in situations where I've been asked to double expected sales forecasts. Not for any particular reason, just because it inflates the top-line growth of any model and someone wanted to look good in front of the executive team and investors. Never mind what might happen six months from now when those projections are hopelessly out of line with reality.

Are there twice as many customers out there? No.

Are they spending twice as much as they used to on a solution? Double No.

This is living in a fantasy land, yet it's very easy for companies big and small to be overly optimistic about their numbers.

Don't become overly reliant on a model, because I can guarantee that it can be changed with a flick of a few bits.

2. Are you sure EVERYONE has this problem?

Many times, we only battle test our idea with people around us, close to us. Family and friends. While people with context to what you do (coworkers, vendors, previous customers) will have context on what you do and what the key problems facing your industry are, you need to be careful in how you ask for their help.

Taken from "The Mom Test", be sure to ask people within the industry you're targeted about their needs WITHOUT SOLUTIONIZING for them!

Remember, if these people know you, they want to be agreeable to you and not hurt your feelings. Like your mom :)

Everything you throw them will be met with "Ah, that's an interesting idea!" Not exactly the best model for unbiased customer research.

It's critically important to have open-ended conversations about their needs. Don't even bring up that you already have an idea that solves the problem you've imagined for them. Listen to what words they use and how they describe the most difficult parts of their job to be done.

Clayton Christensen from Harvard has a great article outlining how we often get false confirmation on what the true "job to be done" is.

3. Are you sure that NOBODY has ever tried this before?

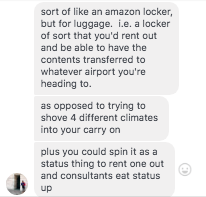

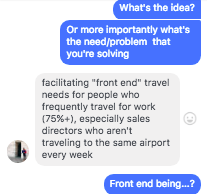

This one sounds a bit obvious, but you'd be surprised how frequently a client has had a great idea, spent some money, only to discover that an existing solution already exists, or was tried several years ago and didn't get off the ground.

Now, there may be a case for "timing" since other moving parts or technology adoption in an industry may unlock an idea that wasn't feasible 5 or 10 years ago, but often times a simple Google search is enlightening.

This is why it's important to talk to potential customers. You may not have found any competing solutions based on how you term the problem, but there may be other ways to describe it.

So how do you do it right?

Well, here's a start:

1. Calculate the unit economics - then give yourself a HUGE margin of error

Remember what I said earlier about models being easy to change? Assume you don't know ALL of the drivers within the market.

There are likely tons of hidden costs - customer acquisition costs, customer care costs and refunds, vendor disputes, business development and sales costs (how long is that sales cycle?), in some cases slippage (know that term?). Some of these are not only hard to model, but you don't even know they exist yet and can't put them in the model!

So it's really important to get to the root of the question.

How much does it cost to produce an item or experience and how much can you charge for it?

Hey! We're making 20% profit, time to start right? Wrong.

While even healthy margins like 50% might be cause to pull the trigger, you should be REALLY conservative, especially if you have no actual sales figures to go off of (or products in similar lines, but then you have to calculate cannibalization!).

On a good day, you should be hoping for at least 100% margin between what it costs to produce an item and how much you're selling it for. (e.g. a $100 experience should cost you no more than $50 to produce). There's so much you can't account for that even that level of conservativism might not be enough.

Talk to a lot of people (in a specific cohort) about their needs in a non-leading way

Rather than pitching your idea to anyone that will listen, it's much better to come up with a set of structured questions that help you really understand the top 2 or 3 needs that a particular cohort has. Don't even mention that you have an idea in the space!

This means you approach these conversations with a far more open mind. It's even better if you can identify and talk with people who have already gone through the pain of the problem you're trying to solve. Think of these conversations as a post-mortem.

Tying in the picture at the top of the article, maybe you've developed a new material that's flame resistant and think that all houses should be made of it. But upon talking to people, especially those that have had fires, you realize a) they aren't that common and b) a handheld fire extinguisher would probably do in 95% of all cases since most large fires start as small ones.

If you started the conversation about building materials, you would draw very different conclusions.

Get Preorders before you build anything

Man, if I was starting a new product, I would love to be Richard Branson.

Two Million dollars in funding? Check

Access to a great team that's talents across multiple disciplines? Check

Able to pick up the phone and get 5 airline CEOs to say yes before a single second or pound is spent on product development? Bingo!

The key advantage here is that Richard Branson already has promises of money coming in the door before he's spent a single cent on R&D. People believe in him and he trusts his people and to do right by the values he's established for his companies. He's even had several spectacular failures! But he keeps trying.

We should all be so lucky, but if nobody is willing to put down even a fraction of the total cost (e.g. look at Tesla and Indiegogo for successful examples of how to do pre-orders right) while you develop the product, they either don't think it's a big enough problem to solve, or they don't trust you to be the one that solves it.

If you're worried that you or your team might be heading down these paths, and would like some empathy and guidance on how to avoid the most common mistakes new businesses make, book a FREE, 30-minute consultation call with Numbers & Letters via this link.

Eric Boromisa is the Managing Director of Numbers & Letters, a human-steered AI-assisted product strategy and market development consultancy.